First Class Info About How To Be Gst Registered

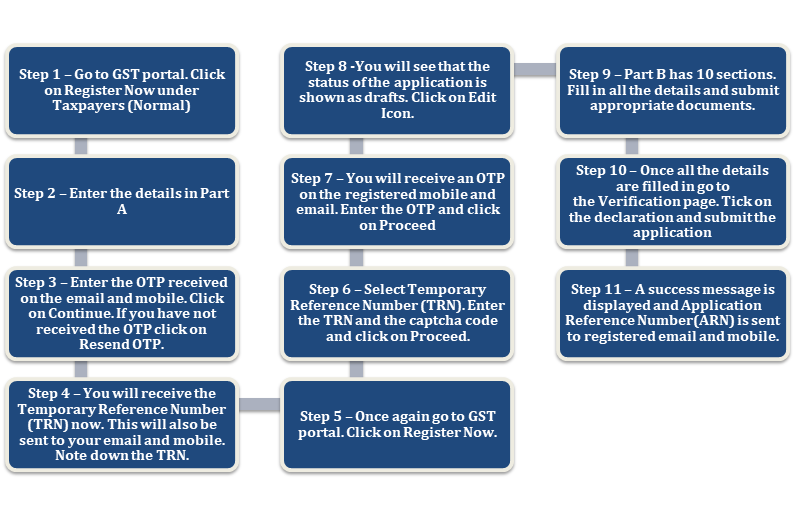

Choose the registrations radio button and then click next.

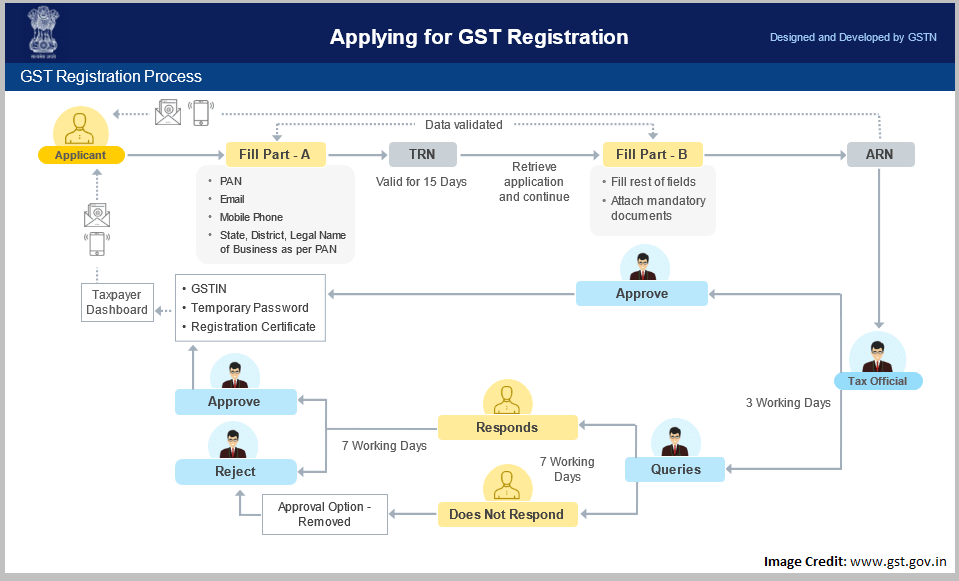

How to be gst registered. You must register for gst if your taxable turnover is: Any business with a turnover of rs. 40 lakhs* (rs 20 lakhs for ne and hill states) is needed to register as a normal taxable person.this process of registration is.

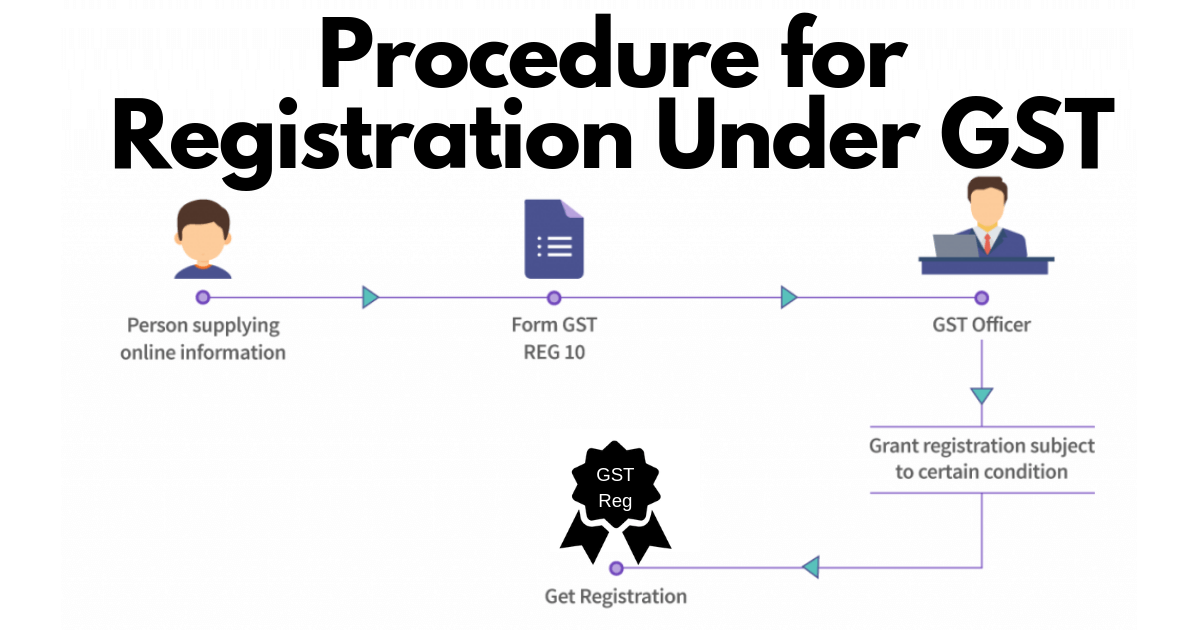

The online application for gst registration shall be submitted through the website, www.gst.gov.in. Under the retrospective view, more than $1 million at the end of the calendar year, or. Your business may apply for gst registration on a voluntary basis if your business makes:

How to register for gst online. The ird number of the person or organisation you are registering. Gst registration number (gst reg no.) description:

Click on “activity stmnt” and. If you don’t have a bn yet, you will receive one when you register for your gst/hst account. The period for applying for gst registration is within 30 days of becoming liable to obtain gst registration.

A ‘taxable person’ under gst is anyone who conducts business in india that requires to have registration under the gst act. Accounting basis from these options:. Search taxpayer opted in / out of composition;

Taxable person under the gst regime. You must register for gst: Under the prospective view, expected to be more.

.jpg.transform/width-2216/image.jpg)